Enhancing Customer Awareness of Cybersecurity Threats in E-Banking: A Study on the Role of AI-based Risk Communication Tools

DOI:

https://doi.org/10.38043/jimb.v10i1.6762Keywords:

Cybersecurity awareness, AI trust, e-banking security, risk communication, user behaviorAbstract

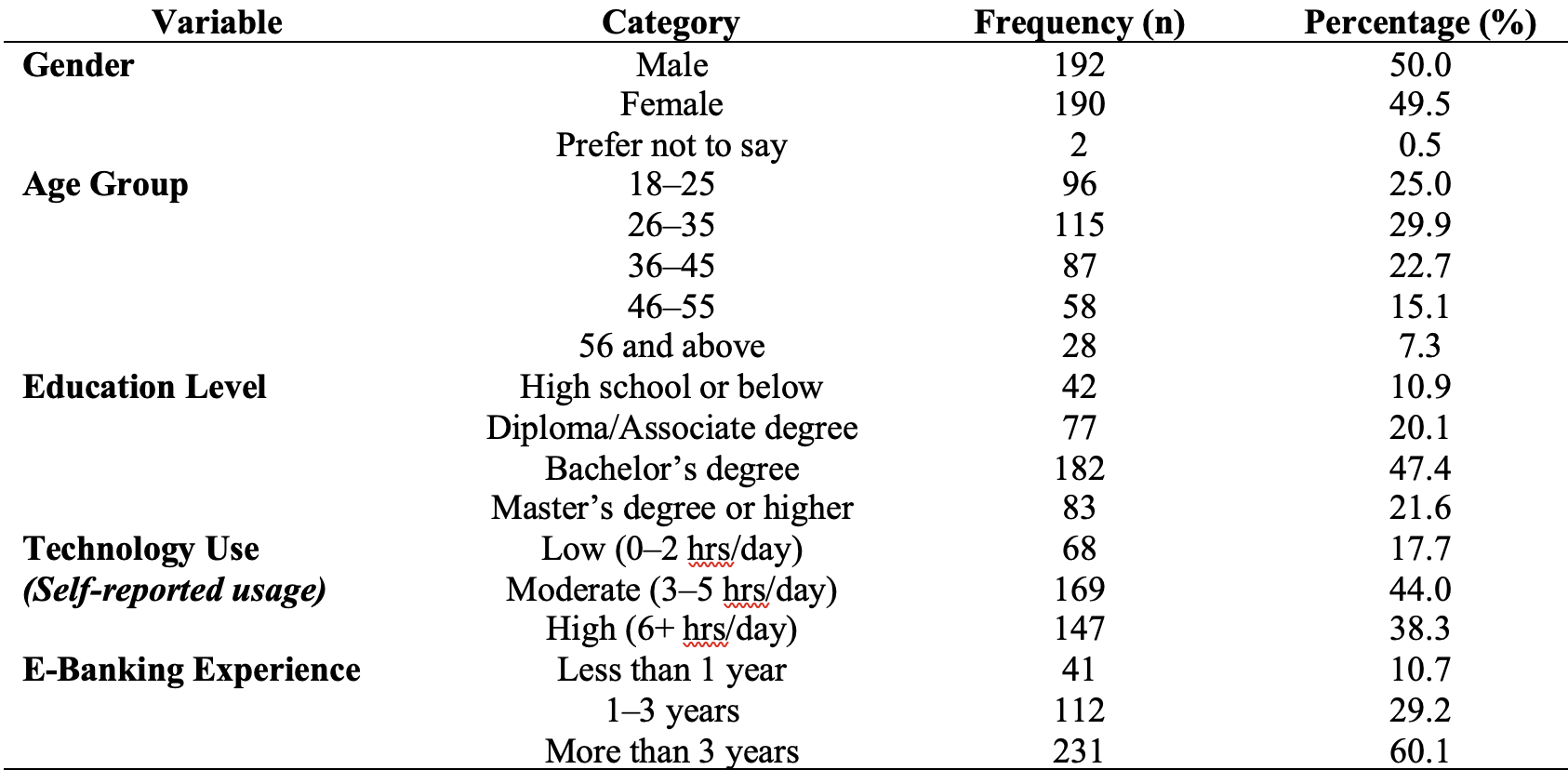

With online banking on the rise, cybersecurity issues still occupy users' and financial institutions' minds. This study examines users' awareness of cybersecurity threats and their trust in artificial intelligence (AI) technology for fraud detection and risk communication in e-banking. A mixed-method design of quantitative survey of 384 users and qualitative interview of 20 participants was used to reflect broader insights. The survey quantified demographics, awareness of security protocols, and confidence in AI technology. Findings show that while users are very well aware of what to anticipate from repeated online threats and are careful with login passwords, they always fail to take the initiative concerning security practices like the changing of passwords. Overall, participants were confident in the application of AI systems, especially the efficiency and pace at which AI identifies fraud versus human agents. Skepticism was found for the effectiveness of chatbots based on AI. Statistical modeling showed that trust in AI strongly correlated with prior experience in cybersecurity, high rates of technology usage, and knowledge of online banking, with education level and age making little impact. The qualitative information further underscored the importance of personalized and clear communication from AI systems, suggesting that the way such machines talk to individuals can make or break trust. The study concludes by suggesting that user education at financial institutions should be enhanced, as well as developing AI systems with a method that employs personal communication approaches. The integration of human support with AI can potentially plug awareness gaps and improve security results across different user segments within the e-banking environment.

Downloads

References

Dzerve, B., Spilbergs, A., Innuse, G., Ozolina, S., Stonane, A., & Maditinos, D. (2023). A Shift in Paradigm: the Financial Education Under the Influence of Digital Transformation. In Digital Transformation, Strategic Resilience, Cyber Security and Risk Management (Vol. 111, pp. 61-82). Emerald Publishing Limited. https://doi.org/10.1108/S1569-37592023000111A005

Gupta, S. (2025). Hacking the System: A Deep Dive into the World of EBanking Crime. The TechnoLegal Dynamics of Cyber Crimes https://doi.org/10.1109/ICIS64839.2024.10887499

Hameed, S., & Nigam, A. (2023). Exploring Indias Generation Z perspective on AI enabled internet banking services. foresight, 25(2), 287-302. https://doi.org/10.1108/FS-10-2021-0213

Hidas, R. E. (2024). Consumer acceptance of the usage of artificial intelligence in the banking sector (Doctoral dissertation). http://hdl.handle.net/10400.14/47704

Jim, M. M. I., & Munira, M. S. K. (2024). The Role Of AI In Strengthening Data Privacy For Cloud Banking. Innovatech Engineering Journal, 1(01), 10-70937. https://dx.doi.org/10.70937/faet.v1i01.39

Johora, F. T., Hasan, R., Farabi, S. F., Akter, J., & Al Mahmud, M. A. (2024). AI-Powered Fraud Detection in Banking: Safeguarding Financial Transactions. The American journal of management and economics innovations, 6(06), 8-22. https://doi.org/10.37547/tajmei/Volume06Issue06-02

Johri, A., & Kumar, S. (2023). Exploring customer awareness towards their cyber security in the Kingdom of Saudi Arabia: A study in the era of banking digital transformation. Human Behavior and Emerging Technologies, 2023(1), 2103442. https://doi.org/10.1155/2023/2103442

Jyothi, V. E., & Chowdary, N. S. (2024). Challenges and Artificial IntelligenceCentered Defensive Strategies for Authentication in Online Banking. Artificial Intelligence Enabled Management: An Emerging Economy Perspective, 105. https://doi.org/10.1515/9783111172408-007

Karunambikai, R. (2025, April). Securing Net Banking Transactions: The Dynamic Duo of AI and Blockchain Technology. In 2025 8th International Conference on Trends in Electronics and Informatics (ICOEI) (pp. 668-673). IEEE. https://doi.org/10.1109/ICOEI65986.2025.11013158

Kaur, S. (2025). Banking Transformation: Artificial Intelligence's Effect on the Current Financial Environment. In Navigating Data Science in the Age of AI: Exploring Possibilities of Generative Intelligence (pp. 131-145). Emerald Publishing Limited. https://doi.org/10.1108/978-1-83608-432-720251007

Khan, H. U., Malik, M. Z., Nazir, S., & Khan, F. (2023). Utilizing bio metric system for enhancing cyber security in banking sector: A systematic analysis. Ieee Access, 11, 80181-80198. https://doi.org/10.1109/ACCESS.2023.3298824

Mller, D.P.F. (2023). Cybersecurity in Digital Transformation. In: Guide to Cybersecurity in Digital Transformation. Advances in Information Security, vol 103 . Springer, Cham. https://doi.org/10.1007/978-3-031-26845-8_1

Munira, M. S. K., & Jim, M. M. I. (2024). The Role Of AI In Strengthening Data Privacy For Cloud Banking. Available at SSRN 5083379. https://dx.doi.org/10.2139/ssrn.5083379

Ndukwe, E. R., & Baridam, B. (2023). A Graphical and Qualitative Review of Literature on AI-based Cyber-Threat Intelligence (CTI) in Banking Sector. European Journal of Engineering and Technology Research, 8(5), 59-69. https://doi.org/10.24018/ejeng.2023.8.5.3103

Rahman, M., Ming, T. H., Baigh, T. A., & Sarker, M. (2023). Adoption of artificial intelligence in banking services: an empirical analysis. International Journal of Emerging Markets, 18(10), 4270-4300. https://doi.org/10.1108/IJOEM-06-2020-0724

Riasat, I., Shah, M., & Gonul, M. S. (2025). Strengthening Cybersecurity Resilience: An Investigation of Customers Adoption of Emerging Security Tools in Mobile Banking Apps. Computers, 14(4), 129. https://www.mdpi.com/2073-431X/14/4/129

Saeed, S., Altamimi, S. A., Alkayyal, N. A., Alshehri, E., & Alabbad, D. A. (2023). Digital transformation and cybersecurity challenges for businesses resilience: Issues and recommendations. Sensors, 23(15), 6666. https://www.mdpi.com/1424-8220/23/15/6666

Rodrigues, A. R. D., Ferreira, F. A., Teixeira, F. J., & Zopounidis, C. (2022). Artificial intelligence, digital transformation and cybersecurity in the banking sector: A multi-stakeholder cognition-driven framework. Research in International Business and Finance, 60, 101616. https://doi.org/10.1016/j.ribaf.2022.101616

Sharma, S., Preet, K., & Gupta, N. (2025). The Role of Artificial Intelligence in a New Paradigm: Redefining the Banking Landscape. In Generative AI in FinTech: Revolutionizing Finance Through Intelligent Algorithms (pp. 291-308). Cham: Springer Nature Switzerland. https://doi.org/10.1007/978-3-031-76957-3_15

Srivastava, A., Pandiya, B., & Nautiyal, N. S. (2024). Application of Artificial Intelligence in Risk Assessment and Mitigation in Banks. Artificial Intelligence for Risk Mitigation in the Financial Industry, 27-52. https://doi.org/10.1002/9781394175574.ch2

Tran, T. N. (2025). Systematic Review of Cybersecurity in Banking: Evolution from Pre-Industry 4.0 to Post-Industry 4.0 in Artificial Intelligence, Blockchain, Policies and Practice. arXiv preprint arXiv:2503.00070. https://doi.org/10.48550/arXiv.2503.00070

Undale, P. S., & Shinde, V. (2024). Digital Transformation and Cyber Security: Unveiling Awareness. Humanities & Language: International Journal of Linguistics, Humanities, and Education, 1(3), 191-197. https://doi.org/10.32734/ayr9wh15

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Musawer Hakimi, Ahmad Jamy Kohistani, Faqeed Ahmad Sahnosh, Abdul Wahid Samadzai, Wahidullah Enayat

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.