Optimizing Marketing Strategies in Encouraging the Adoption of Mobile-Based Digital Financial Services among Students

DOI:

https://doi.org/10.38043/jimb.v10i2.7072Keywords:

marketing strategy, financial services adoption, mobile apps, digital financial literacyAbstract

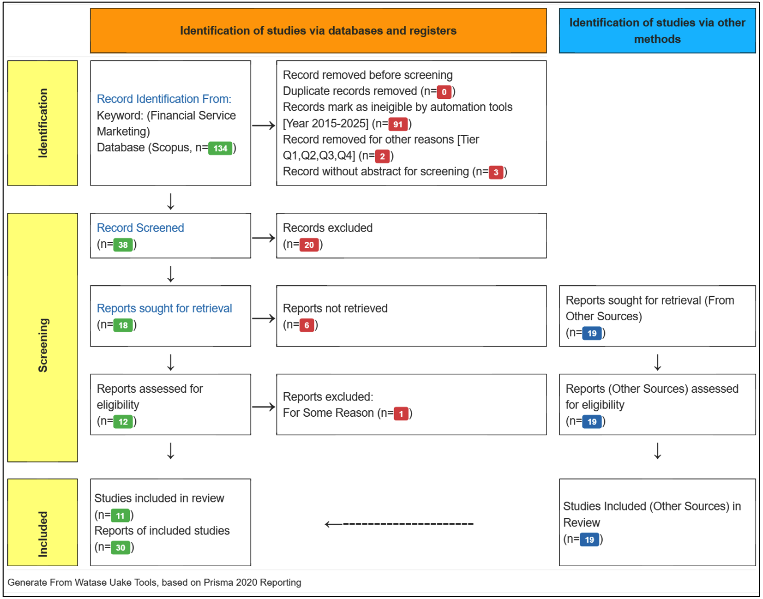

This study analyzes effective marketing strategies to enhance the adoption of mobile application-based financial services among university students, particularly in Indonesia, where mobile banking and e-wallet penetration is high among the youth. The primary aim of this study is to identify and optimize marketing strategies that drive the adoption of digital financial services. Using a Systematic Literature Review (SLR) approach and PRISMA 2020 guidelines, this research analyzes 30 relevant peer-reviewed articles. The synthesis identifies key factors that promote and hinder the adoption of digital financial services. Key findings indicate that digital marketing strategies, particularly through social media, influencer marketing, and personalized content, are effective in increasing students' intention to adopt financial applications. Adoption factors include ease of use, perceived financial benefits, trust in data security, and digital financial literacy. However, major barriers remain, such as low financial literacy and distrust in data security. This research extends TAM and UTAUT models by highlighting the role of modern marketing strategies as external variables influencing adoption. Practically, the study emphasizes the need for integrated education-communication strategies and transparent trust-building mechanisms to enhance adoption. It also recommends focusing on financial literacy education and improving data privacy features to foster broader acceptance among student populations.

Downloads

References

Abad-Segura, E., Gonzlez-Zamar, M. D., Lpez-Meneses, E., & Vzquez-Cano, E. (2020). Financial Technology: Review of trends, approaches and management. Mathematics, 8(6), 136. https://doi.org/10.3390/math8060951

Baker, S. R., & Kueng, L. (2022). Household Financial Transaction Data. In Annual Review of Economics. https://doi.org/10.1146/annurev-economics-051520-023646

Bharti, S. S., Prasad, K., Sudha, S., & Kumari, V. (2024). Correction to: Customer acceptability towards AI-enabled digital banking: a PLS-SEM approach (Journal of Financial Services Marketing, (2023), 28, 4, (779-793), 10.1057/s41264-023-00241-9). Journal of Financial Services Marketing, 29(4), 1653. https://doi.org/10.1057/s41264-023-00250-8

Cao, L., Yang, Q., & Yu, P. S. (2021). Data science and AI in FinTech: an overview. International Journal of Data Science and Analytics, 12(2), 8199. https://doi.org/10.1007/s41060-021-00278-w

Chikweche, T., Lappeman, J., & Egan, P. (2024). Marketing financial services in Africa: exploring the heterogeneous middle-class consumer across nine countries. Journal of Financial Services Marketing, 29(1), 116. https://doi.org/10.1057/s41264-022-00179-4

Dogra, P., & Kaushal, A. (2023). The impact of Digital Marketing and Promotional Strategies on attitude and purchase intention towards financial products and service: A Case of emerging economy. Journal of Marketing Communications, 29(4), 403430. https://doi.org/10.1080/13527266.2022.2032798

Ediagbonya, V., & Tioluwani, C. (2023). The role of fintech in driving financial inclusion in developing and emerging markets: issues, challenges and prospects. Technological Sustainability, 2(1), 100119. https://doi.org/10.1108/TECHS-10-2021-0017

Ellili, N. O. D. (2023). Is there any association between FinTech and sustainability? Evidence from bibliometric review and content analysis. Journal of Financial Services Marketing, 28(4), 748762. https://doi.org/10.1057/s41264-022-00200-w

Elsaid, H. M. (2023). A review of literature directions regarding the impact of fintech firms on the banking industry. Qualitative Research in Financial Markets, 15(5), 693711. https://doi.org/10.1108/QRFM-10-2020-0197

Fares, O. H., Butt, I., & Lee, S. H. M. (2023). Utilization of artificial intelligence in the banking sector: a systematic literature review. Journal of Financial Services Marketing, 28(4), 835852. https://doi.org/10.1057/s41264-022-00176-7

Ferdous, A. S., Akareem, H. S., Viswanathan, M., Hollebeek, L. D., & Ringer, A. (2024). Boosting app-based mobile financial services engagement in B2B subsistence marketplaces: The roles of marketing strategy and app design. Industrial Marketing Management, 119(April), 147161. https://doi.org/10.1016/j.indmarman.2024.04.014

Gomber, P., Koch, J. A., & Siering, M. (2017). Digital Finance and FinTech: current research and future research directions. Journal of Business Economics. https://doi.org/10.1007/s11573-017-0852-x

Hentzen, J. K., Hoffmann, A., Dolan, R., & Pala, E. (2022). Artificial intelligence in customer-facing financial services: a systematic literature review and agenda for future research. International Journal of Bank Marketing, 40(6), 12991336. https://doi.org/10.1108/IJBM-09-2021-0417

Ismatullaev, U. V. U., & Kim, S. H. (2024). Review of the Factors Affecting Acceptance of AI-Infused Systems. Human Factors. https://doi.org/10.1177/00187208211064707

Kim, M., Zoo, H., Lee, H., & Kang, J. (2018). Mobile financial services, financial inclusion, and development: A systematic review of academic literature. Electronic Journal of Information Systems in Developing Countries, 84(5), 117. https://doi.org/10.1002/isd2.12044

Koskelainen, T., Kalmi, P., Scornavacca, E., & Vartiainen, T. (2023). Financial literacy in the digital ageA research agenda. Journal of Consumer Affairs, 57(1), 507528. https://doi.org/10.1111/joca.12510

Li, Z. (2022). The Marketing Prospects of Consumer Trust in Banking Services to Reduce Perceived Financial Risk and enhance Intention to Use Internet Banking. International Journal of E-Collaboration, 18(3), 114. https://doi.org/10.4018/IJeC.307128

Manser Payne, E. H., Dahl, A. J., & Peltier, J. (2021). Digital servitization value co-creation framework for AI services: a research agenda for digital transformation in financial service ecosystems. Journal of Research in Interactive Marketing, 15(2), 200222. https://doi.org/10.1108/JRIM-12-2020-0252

Matewos, K. R., Navkiranjit, K. D., & Jasmindeep, K. (2016). Financial literacy for developing countries in Africa: A review of concept, significance and research opportunities. Journal of African Studies and Development, 8(1), 112. https://doi.org/10.5897/jasd2015.0331

Maulina, R., Dhewanto, W., & Faturohman, T. (2023). The integration of Islamic social and commercial finance (IISCF): Systematic literature review, bibliometric analysis, conceptual framework, and future research opportunities. In Heliyon. https://doi.org/10.1016/j.heliyon.2023.e21612

Menberu, A. W. (2024). Technology-mediated financial education in developing countries: a systematic literature review. In Cogent Business and Management. https://doi.org/10.1080/23311975.2023.2294879

Mogaji, E., & Nguyen, N. P. (2022). Managers understanding of artificial intelligence in relation to marketing financial services: insights from a cross-country study. International Journal of Bank Marketing, 40(6), 12721298. https://doi.org/10.1108/IJBM-09-2021-0440

Morrison, S., Pitt, L., & Kietzmann, J. (2015). Technology and financial services: Marketing in times of U-commerce. Journal of Financial Services Marketing, 20(4), 273281. https://doi.org/10.1057/fsm.2015.18

Mukerjee, K. (2024). Correction to: Augmented reality and customer engagement in the context of e-banking (Journal of Financial Services Marketing, (2024), 29, 4, (1559-1571), 10.1057/s41264-024-00284-6). Journal of Financial Services Marketing, 29(4), 16551656. https://doi.org/10.1057/s41264-024-00290-8

Nesse, P. J., Risnes, O., & Hallingby, H. S. (2018). Management of Mobile Financial ServicesReview and Way Forward. Finance & Economics Readings, 4967. https://doi.org/10.1007/978-981-10-8147-7_4

Pattnaik, D., Ray, S., & Raman, R. (2024). Applications of artificial intelligence and machine learning in the financial services industry: A bibliometric review. Heliyon, 10(1), e23492. https://doi.org/10.1016/j.heliyon.2023.e23492

Rakib, M. R. H. K., Azam, M. S., & Pramanik, S. A. K. (2024). Enhancing Customer Loyalty in Financial Service through Harnessing Relationship Marketing: The Mediating Effects of Brand Image. International Journal of Electronic Customer Relationship Management, 14(1). https://doi.org/10.1504/ijecrm.2024.10062483

Rufaidah, F., Karyani, T., Wulandari, E., & Setiawan, I. (2023). A Review of the Implementation of Financial Technology (Fintech) in the Indonesian Agricultural Sector: Issues, Access, and Challenges. In International Journal of Financial Studies. https://doi.org/10.3390/ijfs11030108

Sahi, A. M., Khalid, H., Abbas, A. F., Zedan, K., Khatib, S. F. A., & Amosh, H. Al. (2022). The Research Trend of Security and Privacy in Digital Payment. In Informatics. https://doi.org/10.3390/informatics9020032

Shaikh, A. A., Alamoudi, H., Alharthi, M., & Glavee-Geo, R. (2023). Advances in mobile financial services: a review of the literature and future research directions. In International Journal of Bank Marketing (Vol. 41, Issue 1). https://doi.org/10.1108/IJBM-06-2021-0230

Sharma, P., & Shrivastava, A. K. (2021). Marketing Strategy for Financial Services in Indian Financial Service Institutions. FIIB Business Review, 10(4), 404412. https://doi.org/10.1177/2319714521994510

Stone, M., & Laughlin, P. (2016). How interactive marketing is changing in financial services. Journal of Research in Interactive Marketing, 10(4), 338356. https://doi.org/10.1108/JRIM-01-2016-0001

Sumit, A., & Jian, Z. (2020). FinTech Lending and Payment Innovation: A Review. Asia-Pacific Journal of Financial Studies, 1(1), 1115.

Tay, L. Y., Tai, H. T., & Tan, G. S. (2022). Digital financial inclusion: A gateway to sustainable development. Heliyon, 8(6), e09766. https://doi.org/10.1016/j.heliyon.2022.e09766

Tuyon, J., Onyia, O. P., Ahmi, A., & Huang, C. H. (2024). Correction to: Sustainable financial services: reflection and future perspectives (Journal of Financial Services Marketing, (2023), 28, 4, (664-690), 10.1057/s41264-022-00187-4). Journal of Financial Services Marketing, 29(1), 200. https://doi.org/10.1057/s41264-022-00196-3

Xiao, J. J., Huang, J., Goyal, K., & Kumar, S. (2022). Financial capability: a systematic conceptual review, extension and synthesis. International Journal of Bank Marketing, 40(7), 16801717. https://doi.org/10.1108/IJBM-05-2022-0185

Yang, W., Wang, S., Sahri, N. M., Karie, N. M., Ahmed, M., & Valli, C. (2021). Biometrics for internetofthings security: A review. In Sensors. https://doi.org/10.3390/s21186163

Zavolokina, L., Dolata, M., & Schwabe, G. (2016). The FinTech phenomenon: antecedents of financial innovation perceived by the popular press. Financial Innovation, 2(1). https://doi.org/10.1186/s40854-016-0036-7

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Baiq Reinelda Tri Yunarni, Diana Sulianti K. Tobing, Dedy Iswanto

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.