Generation Y Employees Saving Behaviour: Finance Technology-enabled Services in South Sulawesi, Indonesia

DOI:

https://doi.org/10.38043/jimb.v10i2.7037Keywords:

Saving Behaviour, Financial Literacy, Financial Product Knowledge, Technology-enabled Financial Services Innovation, Millennial WorkersAbstract

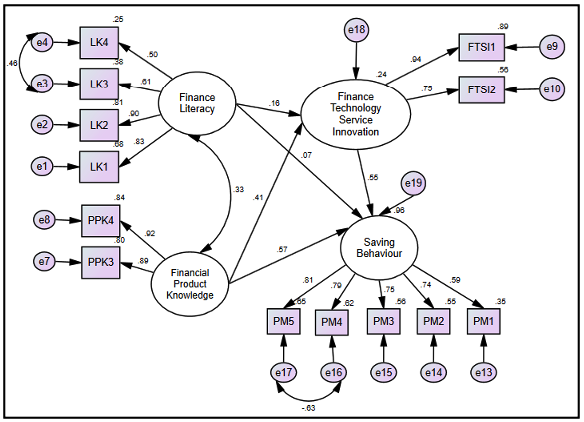

This study was motivated by the low level of saving behavior among millennial workers in the formal sector, despite their broad access to digital financial services. The purpose of this research was to analyze the determinants of saving behavior among millennial employees in South Sulawesi by emphasizing the roles of financial literacy, financial product knowledge, and technology-enabled financial services innovation as a mediating variable. A quantitative approach with a survey method was employed, and the sampling technique used was purposive sampling, involving 316 respondents working in the formal sector across Makassar City, Gowa Regency, and Maros Regency. Data were collected through a five-point Likert-scale questionnaire measuring four key constructs: financial literacy, financial product knowledge, technology-enabled financial services innovation, and saving behavior. The data were analyzed using Structural Equation Modeling (SEM) with AMOS software. The results indicated that both financial literacy and financial product knowledge had positive and significant effects on saving behavior, either directly or indirectly through technology-enabled financial services innovation. Financial product knowledge exerted the strongest influence on saving behavior. The study contributed theoretically by integrating the Theory of Planned Behavior (TPB) and the Technology Acceptance Model (TAM) to explain financial behavior among millennials in a developing country context. Practically, the findings provided insights for financial institutions and policymakers to design integrated financial literacy programs and digital financial innovations that effectively promote sustainable saving behavior in the digital economy era.

Downloads

References

A M Abu Daqar, M., Abu Karsh, S., & Arqawi, S. (2020). Fintech in the eyes of Millennials and Generation Z (the financial behavior and Fintech perception). Banks and Bank Systems, 15(3), 2028. https://doi.org/10.21511/bbs.15(3).2020.03

Aboelmaged, M., & Gebba, T. R. (2013). Mobile Banking Adoption: An Examination of Technology Acceptance Model and Theory of Planned Behavior. International Journal of Business Research and Development, 2(1). https://doi.org/10.24102/ijbrd.v2i1.263

Abrahim, S., Mir, B. A., Suhara, H., Mohamed, F. A., & Sato, M. (2019). Structural equation modeling and confirmatory factor analysis of social media use and education. International Journal of Educational Technology in Higher Education, 16(1). https://doi.org/10.1186/s41239-019-0157-y

Al Tarawneh, M. A., Yong, D. G. F., Dorasamy, M. A., & Nguyen, T. P. L. (2023). Determinant of M-Banking Usage and Adoption among Millennials. Sustainability, 15(10), 8216. https://doi.org/10.3390/su15108216

Aminuddin, A., Mohd Nawi, N., Ismail, S., & Jamaludin, N. (2022). WHAT DRIVES SAVING BEHAVIOUR AMONG UNDERGRADUATE STUDENTS OF UNIVERSITI MALAYSIA TERENGGANU? Universiti Malaysia Terengganu Journal of Undergraduate Research, 4(2), 8188. https://doi.org/10.46754/umtjur.v4i2.277

Amnas, M. B., Selvam, M., & Parayitam, S. (2024). FinTech and Financial Inclusion: Exploring the Mediating Role of Digital Financial Literacy and the Moderating Influence of Perceived Regulatory Support. Journal of Risk and Financial Management, 17(3), 108. https://doi.org/10.3390/jrfm17030108

Andarsari, P. R., & Ningtyas, M. N. (2019). The Role of Financial Literacy on Financial Behavior. JABE (JOURNAL OF ACCOUNTING AND BUSINESS EDUCATION), 4(1), 24. https://doi.org/10.26675/jabe.v4i1.8524

Andini, A. P., & Low, S.-T. (2022). ROLE OF PAST BEHAVIOUR IN APPLICATION OF TPB IN PREDICTING ENERGY SAVING BEHAVIOUR: A REVIEW. Journal of Tourism, Hospitality and Environment Management, 7(27), 383391. https://doi.org/10.35631/jthem.727030

Ariyanti, R., Purwidianti, W., Santoso, S. B., & Pratama, B. C. (2024). DETERMINASI PERILAKU MENABUNG GENERASI Z: DENGAN LITERASI KEUANGAN SEBAGAI PEMEDIASI. Jurnal Proaksi, 11(4), 753770. https://doi.org/10.32534/jpk.v11i4.6540

Baba, M. A., Dawood, M., Haq, Z. U., & Aashish, K. (2023). FinTech Adoption of Financial Services Industry: Exploring the Impact of Creative and Innovative Leadership. Journal of Risk and Financial Management, 16(10), 453. https://doi.org/10.3390/jrfm16100453

Babatunde Adeyeri, T. (2024). Economic Impacts of AI-Driven Automation in Financial Services. International Journal of Scientific Research and Management (IJSRM), 12(07), 67796791. https://doi.org/10.18535/ijsrm/v12i07.em07

Boakye-Adjei, N. Y., Banka, H., Prenio, J., Frost, J., Natarajan, H., Auer, R., & Faragallah, A. (2023). Can central bank digital currencies help advance financial inclusion? Journal of Payments Strategy & Systems, 17(4), 433. https://doi.org/10.69554/ksvn7890

Budiyanto, A., Bali Pamungkas, I., Lubis, I., & Erlan Maulana, A. (2025). Technology acceptance model, trust, and financial behavior in shaping consumer well-being: Insights from fintech adoption in urban Indonesia. Innovative Marketing, 21(2), 197210. https://doi.org/10.21511/im.21(2).2025.16

Carpena, F., & Zia, B. (2020). The causal mechanism of financial education: Evidence from mediation analysis. Journal of Economic Behavior & Organization, 177, 143184. https://doi.org/10.1016/j.jebo.2020.05.001

Che Nawi, N., Seduram, L., Mamun, A. A., & Hayat, N. (2022). Promoting Sustainable Financial Services Through the Adoption of eWallet Among Malaysian Working Adults. Sage Open, 12(1), 215824402110711. https://doi.org/10.1177/21582440211071107

Chen, Q. (2024). Fintech Innovation in Micro and Small Business Financing. International Journal of Global Economics and Management, 2(1), 284290. https://doi.org/10.62051/ijgem.v2n1.36

Chong, Y.-L., Lui, T.-K., & Go, Y.-H. (2024). EXPLORING THE MEDIATING EFFECT OF PERCEIVED EASE OF USE AND PERCEIVED USEFULNESS ON ACTUAL ADOPTION OF MOBILE WALLETS IN MALAYSIA. Malaysian Journal of Business and Economics (MJBE), 11(1), 7389. https://doi.org/10.51200/mjbe.v11i1.5290

Ebirim, G., & Odonkor, B. (2024). ENHANCING GLOBAL ECONOMIC INCLUSION WITH FINTECH INNOVATIONS AND ACCESSIBILITY. Finance & Accounting Research Journal, 6(4), 648673. https://doi.org/10.51594/farj.v6i4.1067

Falke, A., Schrder, N., & Hofmann, C. (2021). The influence of values in sustainable consumption among millennials. Journal of Business Economics, 92(6), 899928. https://doi.org/10.1007/s11573-021-01072-7

Filippini, M., Leippold, M., & Wekhof, T. (2024). Sustainable finance literacy and the determinants of sustainable investing. Journal of Banking & Finance, 163, 107167. https://doi.org/10.1016/j.jbankfin.2024.107167

Fitriah, W. (2021). FINANCIAL LITERACY AND FINANCIAL INCLUSION ON THE FINANCIAL PLANNING OF THE CITY OF PALEMBANG. Review of Management and Entrepreneurship, 5(1), 1932. https://doi.org/10.37715/rme.v5i1.1629

Galanov, V. A., & Galanova, A. V. (2020). Finance Literacy, Finance Trust and Finance Fraud. Vestnik of the Plekhanov Russian University of Economics, 3, 157165. https://doi.org/10.21686/2413-2829-2020-3-157-165

Gul, S., & Ahmed, W. (2024). Enhancing the Theory of Planned Behavior with Perceived Consumer Effectiveness and Environmental Concern towards Pro-Environmental Purchase Intentions for Eco-Friendly Apparel: A Review Article. Bulletin of Business and Economics (BBE), 13(1). https://doi.org/10.61506/01.00270

Harsono, I., & Suprapti, I. A. P. (2024). The Role of Fintech in Transforming Traditional Financial Services. Accounting Studies and Tax Journal (COUNT), 1(1), 8191. https://doi.org/10.62207/gfzvtd24

Hasan, M. H., Dewan, M. A., Hossain, M. Z., & Hasan, L. (2024). FinTech and Sustainable Finance: How is FinTech Shaping the Future of Sustainable Finance? European Journal of Management, Economics and Business, 1(3), 100115. https://doi.org/10.59324/ejmeb.2024.1(3).09

Hua, L., & Wang, S. (2019). Antecedents of Consumers Intention to Purchase Energy-Efficient Appliances: An Empirical Study Based on the Technology Acceptance Model and Theory of Planned Behavior. Sustainability, 11(10), 2994. https://doi.org/10.3390/su11102994

Ikue, N., Ariolu, C., Musa, A., Ikemenjima, I., & Denwi, J. (2022). Factors Influencing Saving Behaviour of Nigerians. International Journal of Finance and Accounting, 7(3), 3353. https://doi.org/10.47604/ijfa.1626

Irimia-Diguez, A., Velicia-Martn, F., & Aguayo-Camacho, M. (2023). Predicting Fintech Innovation Adoption: the Mediator Role of Social Norms and Attitudes. Financial Innovation, 9(1). https://doi.org/10.1186/s40854-022-00434-6

Kangwa, D., Shaikh, J. M., & Mwale, J. T. (2021). The Social Production of Financial Inclusion of Generation Z in Digital Banking Ecosystems. Australasian Business, Accounting and Finance Journal, 15(3), 95118. https://doi.org/10.14453/aabfj.v15i3.6

Kharisma, D. B. (2020). Urgency of financial technology (Fintech) laws in Indonesia. International Journal of Law and Management, 63(3), 320331. https://doi.org/10.1108/ijlma-08-2020-0233

Khasawneh, O., & Albahsh, R. (2024). Why do people use a mobile wallet? The case of fintech companies in Jordan. Investment Management and Financial Innovations, 21(2), 89102. https://doi.org/10.21511/imfi.21(2).2024.07

Koskelainen, T., Kalmi, P., Scornavacca, E., & Vartiainen, T. (2023). Financial literacy in the digital ageA research agenda. Journal of Consumer Affairs, 57(1), 507528. https://doi.org/10.1111/joca.12510

La Barbera, F., & Ajzen, I. (2020). Control Interactions in the Theory of Planned Behavior: Rethinking the Role of Subjective Norm. Europes Journal of Psychology, 16(3), 401417. https://doi.org/10.5964/ejop.v16i3.2056

Lahiri, S., & Biswas, S. (2022). Does financial literacy improve financial behavior in emerging economies? Evidence from India. Managerial Finance, 48(9/10), 14301452. https://doi.org/10.1108/mf-09-2021-0440

Lediestiani, S., & Defrizal, D. (2025). Pengaruh Financial Literacy dan Financial Attitude Terhadap Prilaku Konsumtif Mahasiswa( Studi kasus Mahasiswa Universitas Bandar Lampung). Jurnal Ekonomi Bisnis, Manajemen Dan Akuntansi (Jebma), 5(1), 109118. https://doi.org/10.47709/jebma.v5i1.5174

Ma, Y. (2023). Financial Technology and Monetary Policy Reform. BCP Business & Management, 49, 133138. https://doi.org/10.54691/bcpbm.v49i.5417

Mat Zin, S. H. H., Moktar, B., Zakaria, S. H., & Che Md Nor, R. (2023). Modelling Online Shopping Behaviour Patterns among Higher Education Consumers: A Structural Equation Modelling (SEM-AMOS) Approach. Information Management and Business Review, 15(2(I)), 5467. https://doi.org/10.22610/imbr.v15i2(i).3446

Mothobi, O., & Kebotsamang, K. (2024). The impact of network coverage on adoption of Fintech and financial inclusion in sub-Saharan Africa. Journal of Economic Structures, 13(1). https://doi.org/10.1186/s40008-023-00326-7

Naumovska, L. (2017). Marketing Communication Strategies for Generation Y Millennials. Business Management and Strategy, 8(1), 123. https://doi.org/10.5296/bms.v8i1.10260

Nguyen, T. T., Thi Thu Truong, H., & Le-Anh, T. (2023). Online Purchase Intention Under the Integration of Theory of Planned Behavior and Technology Acceptance Model. Sage Open, 13(4). https://doi.org/10.1177/21582440231218814

Nicolini, G., & Haupt, M. (2019). The Assessment of Financial Literacy: New Evidence from Europe. International Journal of Financial Studies, 7(3), 54. https://doi.org/10.3390/ijfs7030054

Normawati, R. A., Arifah, R., Sri, N., Rahayu, M., & Worokinasih, S. (2022). FINANCIAL SATISFACTION ON MILLENNIALS: EXAMINING THE RELATIONSHIP BETWEEN FINANCIAL KNOWLEDGE, DIGITAL FINANCIAL KNOWLEDGE, FINANCIAL ATTITUDE, AND FINANCIAL BEHAVIOR. Jurnal Aplikasi Manajemen, 20(2). https://doi.org/10.21776/ub.jam.2022.020.02.12

Nurhayati, M., Kusumawardani, N., Saputra, A. R. P., & Santosa, A. (2023). Competence, Innovative Work Behavior, and Work Engagement: A Comparison of Generation X and Millennials. Jurnal Organisasi Dan Manajemen, 19(2), 446460. https://doi.org/10.33830/jom.v19i2.4855.2023

Pamungkas, B. A., Mulyanto, H., & Andriyani, M. (2022). Literasi Keuangan dan Pendapatan Usaha dalam Mempengaruhi Perilaku Menabung Pelaku UKM. MASTER: Jurnal Manajemen Strategik Kewirausahaan, 1(2), 205212. https://doi.org/10.37366/master.v1i2.70

Prabhakaran, S., & L, M. (2023). Perception vs. reality: Analysing the nexus between financial literacy and fintech adoption. Investment Management and Financial Innovations, 20(4), 1325. https://doi.org/10.21511/imfi.20(4).2023.02

Putra, B. H. (2018). Pengaruh Sosialisasi Keuangan Keluarga Terhadap Perilaku Menabung Mahasiswa. JPEKA: Jurnal Pendidikan Ekonomi, Manajemen Dan Keuangan, 2(2), 107. https://doi.org/10.26740/jpeka.v2n2.p107-114

Rajeh, M. T. (2022). Modeling the theory of planned behavior to predict adults intentions to improve oral health behaviors. BMC Public Health, 22(1). https://doi.org/10.1186/s12889-022-13796-4

Rizqi Febriandika, N., Hakimi, F., Harun, H., & Masrizal, M. (2023). Determinants of consumer adoption of Islamic mobile banking services in Indonesia. Banks and Bank Systems, 18(4), 3043. https://doi.org/10.21511/bbs.18(4).2023.04

Rochendi, T., Dhyanasaridewi, I. D., & Rita, R. (2022). PENTINGNYA LITERASI KEUANGAN BAGI MASYARAKAT. KOMPLEKSITAS: JURNAL ILMIAH MANAJEMEN, ORGANISASI DAN BISNIS, 11(1), 2735. https://doi.org/10.56486/kompleksitas.vol11no1.200

Rodrigues, M. A., Oliveira, L., Carvalho, M. A., & Barbosa, A. (2024). How digital influencer content and characteristics influence Generation Y persuasiveness and purchase intention. Tourism & Management Studies, 20(2), 2538. https://doi.org/10.18089/tms.20240203

Sani, A. A. (2020). Finacial Inclusion Profile In East Java. Al-Amwal: Jurnal Ekonomi Dan Perbankan Syariah, 12(1), 60. https://doi.org/10.24235/amwal.v1i1.6160

Sari, M. P., Baining, M. E., & Saijun, S. (2024). Peran OJK ( Otoritas Jasa Keuangan) dalam Meningkatkan Literasi Keuangan pada Masyarakat. Journal Development, 12(2), 210223. https://doi.org/10.53978/jd.v12i2.410

Satsios, N., & Hadjidakis, S. (2018). Applying the Theory of Planned Behaviour (TPB) in Saving Behaviour of Pomak Households. International Journal of Financial Research, 9(2), 122. https://doi.org/10.5430/ijfr.v9n2p122

Sethuraman, P., G, A., & M, R. (2023). Social Medias Effect on Millennials and Generation Zs Green Purchasing Habits. International Journal of Professional Business Review, 8(5), e01470. https://doi.org/10.26668/businessreview/2023.v8i5.1470

Setiawan, B., Nugraha, D. P., Irawan, A., Nathan, R. J., & Zoltan, Z. (2021). User Innovativeness and Fintech Adoption in Indonesia. Journal of Open Innovation: Technology, Market, and Complexity, 7(3), 188. https://doi.org/10.3390/joitmc7030188

Setiawan, M., Effendi, N., Santoso, T., Dewi, V. I., & Sapulette, M. S. (2020). Digital financial literacy, current behavior of saving and spending and its future foresight. Economics of Innovation and New Technology, 31(4), 320338. https://doi.org/10.1080/10438599.2020.1799142

Sobaih, A. E. E., & Elshaer, I. A. (2023). Risk-Taking, Financial Knowledge, and Risky Investment Intention: Expanding Theory of Planned Behavior Using a Moderating-Mediating Model. Mathematics, 11(2), 453. https://doi.org/10.3390/math11020453

Srivastava, S., Mohta, A., & Shunmugasundaram, V. (2023). Adoption of digital payment FinTech service by Gen Y and Gen Z users: evidence from India. Digital Policy, Regulation and Governance, 26(1), 95117. https://doi.org/10.1108/dprg-07-2023-0110

Sugiatni, E. (2022). OTORITAS JASA KEUANGAN DAN SISTEM MONETER INDONESIA. Center for Open Science. https://doi.org/10.31219/osf.io/zvwgy

Sulistianingsih, H., Masruri, M., & Riski, T. R. (2019). Literasi Keuangan dan Perilaku Keuangan. Manajemen Dan Kewirausahaan, 10(1), 1. https://doi.org/10.31317/jmk.10.1.1-15.2019

Sultana, N., Chowdhury, R. S., & Haque, A. (2023). Gravitating towards Fintech: A study on Undergraduates using extended UTAUT model. Heliyon, 9(10), e20731. https://doi.org/10.1016/j.heliyon.2023.e20731

Suntornsan, S., Chudech, S., & Janmaimool, P. (2022). The Role of the Theory of Planned Behavior in Explaining the Energy-Saving Behaviors of High School Students with Physical Impairments. Behavioral Sciences, 12(9), 334. https://doi.org/10.3390/bs12090334

Suwatno, S., Mulyani, H., & Waspada, I. (2021). Forming Students Saving Behaviour through Financial Literacy, Parental Financial Education, and Self Control. Jurnal Pendidikan Akuntansi & Keuangan, 9(2), 127136. https://doi.org/10.17509/jpak.v9i2.34944

Thanapongporn, A., Gowanit, C., & Saengchote, K. (2023). Factors Shaping Thai Millennials Low-Carbon Behavior: Insights from Extended Theory of Planned Behavior. HighTech and Innovation Journal, 4(3), 482504. https://doi.org/10.28991/hij-2023-04-03-02

Tian, Y., Chan, T. J., Kasim, M. A., & Suki, N. M. (2023). Moderating Role of Perceived Trust and Perceived Service Quality on Consumers Use Behavior of Alipay e-wallet System: The Perspectives of Technology Acceptance Model and Theory of Planned Behavior. Human Behavior and Emerging Technologies, 2023, 114. https://doi.org/10.1155/2023/5276406

Yang, M., Mohiuddin, M., Zainol, N. R., Nawi, N. C., & Mamun, A. A. (2021). Cashless Transactions: A Study on Intention and Adoption of e-Wallets. Sustainability, 13(2), 831. https://doi.org/10.3390/su13020831

Yucel, O., Celik, G., & Yilmaz, Z. (2023). Sustainable Investment Attitudes Based on Sustainable Finance Literacy and Perceived Environmental Impact. Sustainability, 15(22), 16026. https://doi.org/10.3390/su152216026

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Muh. Indra Fauzi Ilyas, Rohani, Sri Wahyuni HS, Asriyana

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.