The Effect of Return Expectations and Perceived Risk on Intention to Invest in Crypto Assets: Evidence from Indonesian Investors

DOI:

https://doi.org/10.38043/jimb.v9i1.5598Keywords:

Cryptocurrency Investment, Return Expectations, Risk Perception, Investment InterestAbstract

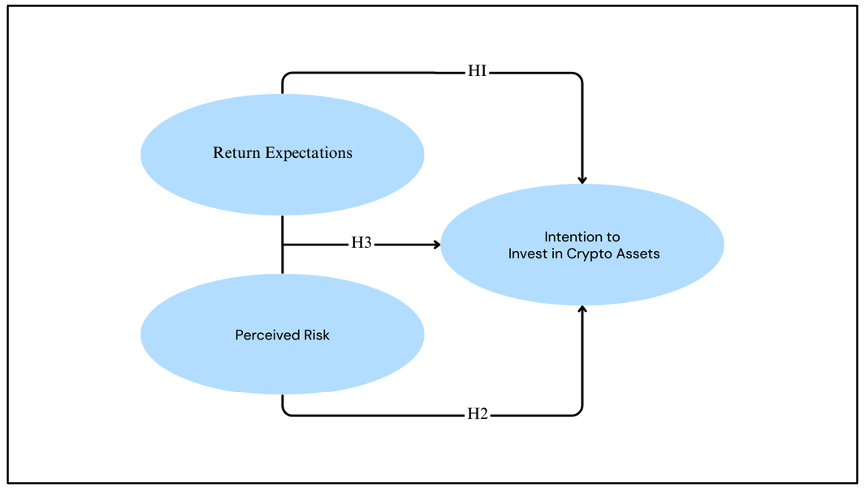

Investment in cryptocurrency offers high potential returns but is also accompanied by significant risks due to substantial price fluctuations. The volatile nature of crypto assets makes them a subject of intense interest and caution among investors. Before engaging in transactions, investors typically evaluate the potential risks and returns they may obtain, balancing the allure of high profits against the possibility of significant losses. Therefore, investors' intention to invest in crypto assets is based on these two factors: return expectations and risk perception. This study employs multiple linear regression analysis using SPSS software to examine the relationship between these variables. The sampling technique used is purposive sampling, with a sample size determined to be between 45 and 90 respondents to ensure statistical validity. The questionnaire was distributed online to the crypto asset investor community in Indonesia, and respondents provided answers using a Likert scale from 1 (Strongly Disagree) to 5 (Strongly Agree). The data analysis reveals that return expectations have a positive and significant effect on investment interest in crypto assets. Additionally, risk perception also has a positive and significant effect on investment interest in crypto assets, indicating that even perceived risks do not deter investment interest, possibly due to the high return potential. Furthermore, return expectations and risk perception simultaneously have a positive and significant effect on investment interest in crypto assets, suggesting that both factors jointly influence investment intentions. These findings provide valuable insights for investors and market participants in understanding the factors influencing investment decisions in cryptocurrency, highlighting the importance of managing both expected returns and perceived risks in investment strategies.

Downloads

References

Aini, N., Maslichah, M., & Junaidi, J. (2019). Pengaruh pengetahuan dan pemahaman investasi, modal minimum investasi, return, risiko dan motivasi investasi terhadap minat mahasiswa berinvestasi di pasar modal (studi pada mahasiswa fakultas ekonomi dan bisnis kota Malang). e-Jurnal Ilmiah Riset Akuntansi, 8(5).

Amalia, H. F. (2019). Pengaruh return dan risiko terhadap minat investasi mahasiswa di galeri investasi. Institut Agama Islam Negeri Ponorogo.

Ansofino, Jolianis, Yolamalinda, & Arfilindo, H. (2016). Buku ajar ekonometrika. Yogyakarta: Deepublisher.

Aren, S., & Zengin, A. N. (2016). Influence of financial literacy and risk perception on choice of investment. Paper presented at the 12th International Strategic Management Conference, ISMC 2016, October 28–30, Antalya, Turkey.

Ashariansyah, A. R., Iriawan, N., & Mukarromah, A. (2020). Pemodelan harga cryptocurrency menggunakan Markov switching autoregressive. INFERENSI, 3(2).

Bappebti. (2022). Milenial jangan sekadar ikut tren aset kripto. Buletin Bappebti.

Bhiantara, I. B. P. (2018). Teknologi blockchain cryptocurrency di era revolusi digital. Paper presented at the Seminar Nasional Pendidikan Teknik Informatika, Bali.

Bungin, M. B. (2010). Metodologi penelitian kuantitatif: Komunikasi, ekonomi, dan kebijakan publik serta ilmu-ilmu sosial lainnya (2nd ed.). Jakarta: Kencana.

Burhanudin, H., Putra, S. B. M., & Hidayati, S. A. (2021). Pengaruh pengetahuan investasi, manfaat investasi, motivasi investasi, modal minimal investasi, dan return investasi terhadap minat investasi di pasar modal (studi pada mahasiswa fakultas ekonomi dan bisnis Universitas Mataram). Distribusi - Journal of Management and Business, 9(1). https://doi.org/10.29303/distribusi.v9i1.137

Chania, M. F., Sara, O., & Sadalia, I. (2021). Analisis risk dan return investasi pada Ethereum dan saham LQ45. Studi Ilmu Manajemen dan Organisasi (SIMO), 2(2). https://doi.org/10.35912/simo.v2i2.669

Fahreza, M., & Surip, N. (2019). Pengaruh pengetahuan investasi, persepsi risiko, dan persepsi kontrol perilaku terhadap minat investasi saham. Jurnal SWOT, 8(2).

Fareva, I., Zulaihati, S., & Sumiati, A. (2021). Pengaruh ekspektasi return dan persepsi risiko terhadap minat investasi investor mahasiswa yang terdaftar di galeri investasi Bursa Efek Indonesia Universitas Negeri Jakarta. Indonesian Journal of Economy, Business, Entrepreneurship, and Finance, 1(2). https://doi.org/10.53067/ijebef

Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention, and behavior: An introduction to theory and research. Addison-Wesley Publishing Company.

Ghozali, I. (2016). Aplikasi analisis multivariete dengan program IBM SPSS 23 (8th ed.). Semarang: Badan Penerbit Universitas Diponegoro.

Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2013). Multivariate data analysis (7th ed.). Pearson Education Limited.

Hermanto. (2017). Perilaku mahasiswa ekonomi di Universitas Esa Unggul dalam melakukan investasi di pasar modal. Jurnal Ekonomi & Kebijakan Publik, 8(2). https://doi.org/10.47007/jeko.v8i01.1733

Huda, N., & Hambali, R. (2020). Risiko dan tingkat keuntungan investasi cryptocurrency. Jurnal Manajemen dan Bisnis: Performa, 17(1). https://doi.org/10.29313/performa.v17i1.7236

Jogiyanto, H. (2017). Teori portofolio dan analisis investasi. Yogyakarta.

Listyani, T. T., Rois, M., & Prihati, S. (2019). Analisis pengaruh pengetahuan investasi, pelatihan pasar modal, modal investasi minimal dan persepsi risiko terhadap minat investasi mahasiswa di pasar modal (studi pada PT Phintraco Sekuritas Branch Office Semarang). Jurnal Aktual Akuntansi Keuangan Bisnis Terapan, 2(1).

Muhajirin, & Panorama, M. (2017). Pendekatan praktis: Metode penelitian kualitatif dan kuantitatif. Yogyakarta: Idea Press.

Nadeem, M. A., Liu, Z., Pitafi, A. H., Younis, A., & Xu, Y. (2021). Investigating the adoption factors of cryptocurrencies—A case of Bitcoin: Empirical evidence from China. SAGE Journal, 11(1). https://doi.org/10.1177/2158244021998704

Sadeghi, S., & Barzegari, J. (2020). Accounting in the fourth industrial revolution: Exploration of digital currency exchanges using AHP method. Annals of Management and Organization Research (AMOR), 2(1). https://doi.org/10.35912/amor.v2i1.556

Salsabila, H. Z., Susanto, & Hutami, L. T. H. (2021). Pengaruh persepsi risiko, manfaat, dan kemudahan penggunaan terhadap keputusan pembelian online pada aplikasi Shopee. Jurnal Ilmiah Manajemen Kesatuan, 9(1).

Setiawan, E. P. (2020). Analisis potensi dan risiko investasi cryptocurrency di Indonesia. Jurnal Manajemen Teknologi, 19(2). http://dx.doi.org/10.12695/jmt.2020.19.2.2

Sihombing, S., Nasution, M. R., & Sadalia, I. (2021). Analisis fundamental cryptocurrency terhadap fluktuasi harga: Studi kasus tahun 2019–2020. Jurnal Akuntansi, Keuangan, dan Manajemen (Jakman), 2(3). https://doi.org/10.35912/jakman.v2i3.373

Tennant, J. (2021). Laporan investor aset kripto di Indonesia tahun 2021—Bagian 1: Perkembangan adopsi aset kripto di Indonesia. Retrieved from Tokenomy: https://tokenomy.medium.com/laporan-investor-aset-kripto-di-indonesia-tahun-2021-bagian-1-perkembangan-adopsi-aset-kripto-d700bfcfbce1

Trisnatio, Y. A., & Pustikaningsih, A. (2018). Pengaruh ekspektasi return, persepsi terhadap risiko, dan self-efficacy terhadap minat investasi saham mahasiswa fakultas ekonomi Universitas Negeri Yogyakarta. Profita: Kajian Ilmu Akuntansi, 6(3).

Wulandari, P. A., Sinarwati, N. K., & Purnamawati, I. G. A. (2017). Pengaruh manfaat, fasilitas, persepsi kemudahan, modal, return, dan persepsi risiko terhadap minat mahasiswa untuk berinvestasi secara online (studi pada mahasiswa jurusan akuntansi program S1 Universitas Pendidikan Ganesha). e-Journal S1 Ak Universitas Pendidikan Ganesha, 8(2).

Zikmund, W. G., Babin, B. J., Carr, J. C., & Griffin, M. (2009). Business research methods (8th ed.). South-Western College Pub.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Made Vera Kristanti Dewi, Ketut Gede Sri Diwya

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.